Just how can Chargebacks Work?

And of course, the goal is to sort out the problem devoid of the companies getting worried at all. Occasionally, the perceived fraud may be an accident.

These fees are supposed to cover the executive rates associated withthe chargeback course of, however for the vendor, the speedy result's extra misplaced profit. Plus, bankers often gauge a merchant’s danger and reliability for the variety of charge-backs they get.

Filing a charge-back does not end a shopper from leaving feedback for any seller. Neither does starting suggestions : whether or not constructive, undesirable, or unbiased – limit the client from submitting a chargeback against the seller. A chargeback items in movement a chain effect. The purchaser’s financial institution drags the cash from PayPal’s service provider standard bank. PayPal’s vendor bank brings the funds from PayPal.

The typical scam protection know-how stack for business can incorporate AVS, CVV, 3D secure, e mail confirmation recources, fraud scoring, gadget fingerprint scanning service, and identical preventative recources. What happens easily accept a chargeback?

Different elements, including our own proprietary website guidelines and the likelihood of applicants’ credit rating approval also influence how and where products appear on this internet site. CreditCards. com doesn't incorporate the complete universe of accessible financial or credit ratings signifies. See the net credit card features for details in regards to the keywords and circumstances of a suggestion. Reasonable hard work is made to manage accurate info.

Merchants are not able to simply agree to playing cards providing they've a closed merchant service. But using a chargeback, the cardholder may successfully talk about the product customer's head and secure a refund from financial institution alone. The financial institution, in flip, may void a bank card deal, then take away funds which were beforehand transferred into the support provider’s bank account and punch the vendor with a significant repayment (or in extreme instances, revoke the product owner's greeting card processing permissions). The Fair Credit Invoicing Act—a federal government legislation surpassed in 1975—offers you the right to argument charges if you are dissatisfied with the transaction through a process known as Claims and Defenses.

Whenever merchants be sure they are featuring immediate and attentive customer support, providing top quality products and services, and attending to purchase details, buyers gained’t possess a legitimate goal to file a chargeback into institution. Friendly fraud definitely will decrease.

Upon common consumers are given one hundred and 20 days by issuers through the date of the charge prove billing affirmation to initiate a argument and in another instances a cardholder usually takes as much as 540 days (18 months). When the merchant is notified of the dispute, they have several choices in which it could respond. It might like to concern a refund, campaign the charge-back or bum and let the charge-back course of.

In these instances, you'll have the best time getting the charge-back reversed, offered you send the proper paperwork. Non-fraud linked chargebacks could also trigger crucial influence upon revenue margins. Claims by cardholders that goods are of poor good quality or flawed could be very good indicators of poor quality supervision while demands that they in no way obtained the product is surely an indication of an faulty order achievement system or an untrustworthy shipper.

- Depending on credit card firm concerned, the process could take about seventy five days.

- Chargebacks may also occur because of pleasant fraudulence, the place the transaction was approved by the buyer but the consumer later makes an attempt to fraudulently reverse the prices.

- They regularly occur any time a client is not able to obtain a refund instantly from you, the seller, and instead intentionally takes the a reimbursement.

- In this case, a bank card is used without the permission or appropriate authorization within the cardboard holder.

How long does a chargeback take?

Cardholders have a 75-120 day chargeback filing window following the transaction refinement date. The time limit differs, depending on the reason for the charge-back. Generally speaking, consumers have a hundred and twenty days arranging a charge-back for concerns linked to: counterfeit or non-counterfeit fraud.

As a merchant, you have received a lot occurring. You happen to be trying to run the corporation, sustain your digital store up-to-date, control employees, stay in the loop for of support services, and ensure you happen to be beginning to see income. It’s a lot tougher than it seems and little prices can add as much as large losses. Protect your supplier portfolio, boost transaction amount, differentiate and develop your enterprise. Provide us while using the data concerning the charge-back, together with every transaction info (similar to proof of cargo).

Can you argue a charge-back?

A chargeback is initiated by the greeting card holder and can (but doesn't always have to) result in a return of funds. A refund can be described as payment operation initiated by the merchant, this refers to a particular card transaction and enables to return the whole or portion of the transaction amount.

Credit Cards

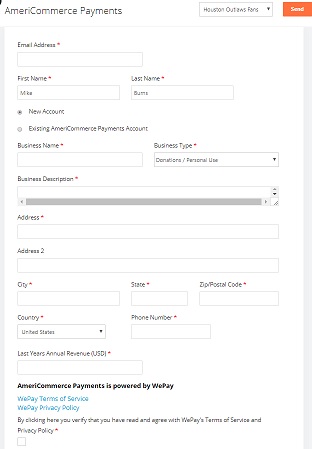

We will notify you by e-mail if a buyer opens a dispute. Consequently we’ll place a temporary keep on almost all funds within the transaction. Our information to providing to avoid quarrels and chargebacks presents recommendations to help you stop these issues from occurring in the first place. But since a customer recordsdata a argument or chargeback, here’s list of positive actions. Give the reseller a sufficient period of time to induce a discount earlier than supposing fraud is usually accountable.

You are able to dispute errors in your bank card invoice by writing a document to your creditor. You can use an example letter in the backside on this guide. During the course of the exploration, you are not obliged to pay the charge involved, however you'll have to pay other parts of your costs.

This is why is necessary for suppliers to do all things in their power to have purchases and transactions nicely documented, and Chargeback FAQ in tough accordance along with the rules set forth by the card networks. If the chargeback is certainly deemed unacceptable by the service agency financial institution, the processor should contact the buyer’s standard bank and advise them of their findings. This occurs in rare cases.

The length of time does a product owner have to dispute a chargeback?

The bulk of reason rules used by consumers and giving banks imply criminal scams (unauthorized transactions). However , the real source of chargebacks—often more than 80 percent of issuances—is friendly scam. Therefore , stores need a fresh and more successful way to investigate and take care of chargebacks.

How to construct a powerful case toward Disputes in Debit Cards?

However , almost all credit card information is released with out assure. When you simply click on the “Apply Now” key, you'll be able to evaluation the bank card terms and conditions over the issuer’s website online. Usually it takes 30 to 45 days to get the conclusion out of your bank.

Tags: ROOT